We people pay money.

- We people pay money if we are forced to do so. We pay our taxes, we pay fees.

- We people pay money for items we need. We pay for food, we pay for cloths, we pay for housing.

- We people pay money for items we like. We pay for a new TV, a smart phone, going to a restaurant, going on vacations.

- We people pay money to show off our status, or to feign a status. We buy brand name clothing, brand name cars and travel to hip locations. Sometimes we do that because we enjoy the holiday destination or we like the feel of a certain shoe or the look of a certain T-shirt, but often we do it to pretend.

Whether it's poor people, average people or rich people, there is no difference in that behavior. Except maybe, that rich people are more avaricious, because that's one ingredient to becoming rich in the first place --- apart from inheriting wealth.

Taxes

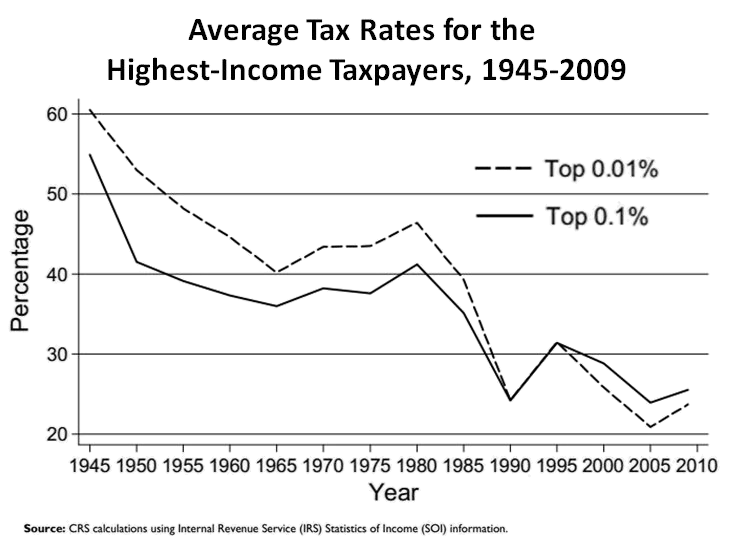

For a wealthy Person there is no immediate gain in paying taxes. They gain more if all the other citizens pay their dues and s/he does not. Someone with a lot of money has also more possibilities to avoid paying taxes. Just pay a little to an advisor who knows how to circumvent taxes and jump through loopholes to drastically reduce the large tax payment.

People have to WANT to pay taxes

Of all the reasons to pay money we only exploit the reason number 1). We are forced.

We probably will never like paying taxes for we don't get the immediate return of investment we get if we buy new shoes.

But what if we exploited reason 4)? What if paying taxes meant that people could show off their status?

The platinum tax-payer-card

The pay-more-premium based on this premise is all around us. We can see it with credit cards, we can see it with the "miles" in flying. It is nothing new to provide a bit of status which makes people feel more special to those who pay a lot with their credit cards. They get "gold member cards" or "platinum cards" and they are happy to pay more, just so that other people can see that card and can assume wealth and status. For all the "Senators" with loads of miles can just skip the long lines of common people waiting to be checked and go through the special entrance where they are patted down a little bit less humiliating and then sit down in the VIP lounge where they are invited to pay double prices just to sit in the fake leather chairs and to feel special.

I propose to create a very visible tax payer status. Someone who pays 1 Million Euros or Dollars in taxes a year should be given the opportunity to show this to all the people around her/him. If it's more than 10 Million the sign should be more special. And for someone who paid 100 Million Dollars of taxes in his lifetime there could be the platinum tax payer card.

Invite them to a very special dinner to those who reached the status this year the first time or again. Give them a valuable pin reflecting his contributions. Provide them with incentives honoring their contribution for society.

And then ask everyone who claims to be rich: "Hey, aren't you supposed to be rich? Didn't you claim to have a status? If so, why don't you have at least gold-tax-payer-status?" and "hey look over there, he's a platinum-tax-payer. Whoooa!" Everyone can see it at the big charity event, because the bit tax payer got his pin and his card.

This --- at least that's my thinking --- provides an incentive to wealthy people to not dodge their tax payments because of peer pressure within the group of wealthy people.

The platinum tax-payer card by Peter Speckmayer is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.