|

| (public domain) |

Working for the society

People in some jobs do good and important things for society. And people in other jobs clearly don't. Sounds pretty obvious.

I'd like to give some examples of jobs of which I think, that they are good good for society: nurse, teacher, medic, sewerman, fireman, ...

I consider this as a problem for society. But there are ways out.

Ways out

IMO, there are basically two solutions to this problem:

- Regulate the wages of the people

- Regulate the taxes people have to pay

Regulating the wages directly would deprive the employers of the possibility to provide reward those who do good work. Since I think, that rewarding good work is a necessary ingredient to get good work done, I therefor don't like the this option.

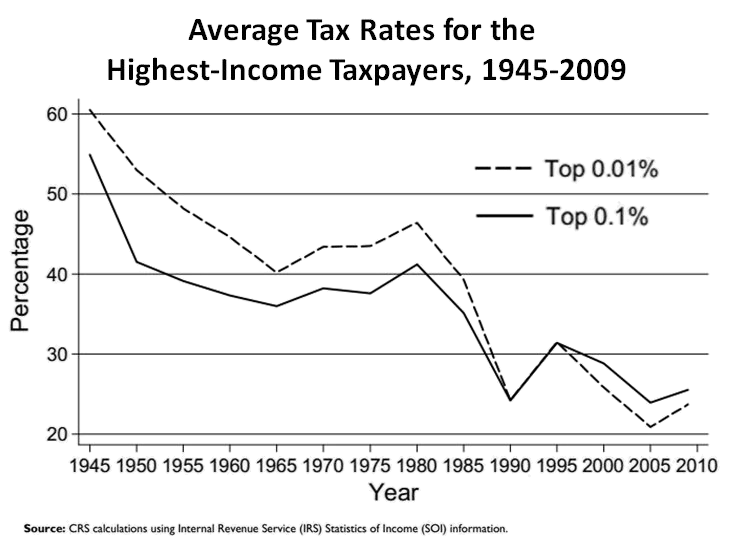

The second option is the regulation of taxes. This is already somehow implemented in progressive tax systems where the tax rate rises progressivly with the income. Whilst this provides a redistribution of some of the wealth in the society, it treats the nurse equal to the stock market broker. The broker just earns so much more, that even with a progressive taxation he still goes home with so much more.

What income taxes should depend on

My proposal is, that taxes should not only depend on the income, but as well on the type of job which is done and its value for the society. I imagine different tax rates depending on both, on the income and on the type of job. Maybe it should be even depend on the work the company does as well.

It is of course difficult to set for each type of work the value the society gains, and probably nobody wants to give that power to a small group of politicians. Especially as today's politians don't seem to be too resistant to lobbying or even being bought completely.

I think, this could be a really fair system. It would provide an incentive for people to work in jobs where they would help the society instead of in jobs which are just there to rip off a large share of money from the financial stream for their own profit. We are the society after all, that's why we should aim for improving our all wellbeing, ... not only mine or yours or his.

Technicalities

Of course, there are some technicalities to be solved, such as which groups of jobs are there and which job belongs to which of the groups. There is as well the issue, that some bankster might try to redefine his job description from "managing a large equity fund and firing people at will" to "cooks food for the poor". Certainly this is not desired and has to be avoided.

|

| (CC BY-SA) |

|

| (public domain) |

You are very welcome to leave your comments! Let me know what you think.

Good taxes by Peter Speckmayer is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.